SIP-24: Terminal SNX Inflation

| Author | |

|---|---|

| Discussions-To | https://github.com/Synthetixio/SIPs/issues/36 |

| Status | Implemented |

| Created | 2019-10-25 |

Simple Summary

This proposal will add a perpetual 2.5% APR annual inflation of SNX starting on September 6, 2023, the 235th week on the SNX inflation schedule.

This SIP is the formal spec successor of deltatiger's Draft SIP Proposal #36, specifically pertaining to terminal inflation.

Abstract

- Terminal inflation is an important mechanism to keep the SNX protocol stable in perpetuity

- With the original inflation schedule, weekly inflation drops from 90.1K to 0 on March 13, 2024

- With inflation smoothing as described in SIP-23, weekly inflation drops below 2.5% on August 30, 2023

Motivation

Perpetual weekly inflation serves as a mechanism to keep the protocol stable for the long term

Specification

Adjust SupplySchedule.sol to account for the following changes:

- Starting on August 30, 2023, the weekly issuance of SNX tokens will adjust to 2.5% on an annualized basis.

- This final model, which is based on the origional proposed model, will stay in place until it is stopped or adjusted.

With Inflation Smoothing and 2.5% annual Terminal Inflation:

Rationale

Perpetual weekly inflation serves as a mechanism to avoid scenarios that would adversely impact the protocol like:

- Minters packing up at the same time due to a lack of rewards

- Synth supply shrinking

- SNX unlocking to be sold down

- SNX price dropping

- sETH LPs getting their income halved and also now dropping in value

- sETH LPs exiting by withdrawing and converting sETH to ETH

- sETH getting smashed out of peg

- Arb pool being unattractive as SNX drops relative to ETH

Test Cases

Standard test cases for Solidity contract compling and deploying onto Ethereum testnets before updating the contract on mainnet.

Implementation

- Update and deploy SupplySchedule.sol to Ropsten, Rinkby, and Kovan

- Update and deploy changes to proxy contracts that reference SupplySchedule.sol on Ethereum testnets

- Update and deploy SupplySchedule.sol to Ethereum mainnet

- Update and deploy changes to Ethereum mainnet proxy contracts that reference SupplySchedule.sol

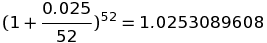

Compounding weekly effects on terminal inflation rate of 2.5% APR

As weekly supply is compounded weekly using a compound formula with a terminal rate of 2.5% APR, the effective rate of inflation compounded weekly over a year is 2.53% APY.

Copyright

Copyright and related rights waived via CC0.